Message from Management

Management policy: Continue growing by contributing to society through the power of chemistry

I was appointed representative director and president of Tosoh in March 2022. At Tosoh, our corporate philosophy is to “Contribute to society through the chemistry of innovation.” This is underpinned by our fundamental management policy of helping realize sustainable global development and promote ongoing growth for the Company by providing a wide variety of chemical products infused with our accumulated technology and knowhow.

I believe that continuing to nurture the trust of stakeholders is the first critical step in ensuring sustainable growth for our Company. As a chemical manufacturer, earning and maintaining the trust of customers, communities and government through safe production and the provision of stable and reliable products forms the foundation of everything we do. At the same time, it is important to continue creating products that can contribute to society as a whole, and the collective property of humankind, in order to enhance profitability in a stable manner, raise corporate value and secure the trust of shareholders, investors, employees and business partners.

The Sustainable Development Goals (SDGs) adopted by the United Nations in 2015 serve as a key guideline toward creating value for society. Under the framework, there are 17 goals representing 17 social issues. In its capacity as a chemical manufacturer, Tosoh is particularly focused on achieving the 13th goal — “Take urgent action to combat climate change and its impact” — which means striving toward carbon neutrality, or decarbonization. To realize this while maintaining current lifestyles, we believe that innovation is vital in every field.

Our products are indispensable materials in a variety of social settings and contribute to society’s ongoing advancement. We must, however, be aware that a large volume of energy is required in the production of these items, which is accompanied by significant CO2 emissions. I recognize that my greatest mission as a member of the top management team is to lead the Company toward sustainable growth while pursuing the global goal of decarbonization.

Overview of FY2022 business results and previous medium-term business plan

Achieved record highs in net sales and operating income

In fiscal 2022, consolidated net sales for the Tosoh Group amounted to ¥918.6 billion, up ¥185.7 billion, or 25.3%, from the previous fiscal year. Marking a new record high, this result was primarily due to higher selling prices following the increased cost of raw materials and fuels such as naphtha and improved trade conditions overseas for the Chlor-alkali Group. In addition, an increase in sales volume due to a recovery in demand in each business field contributed to sales growth.

In terms of profit, operating income amounted to ¥144.0 billion, up ¥56.2 billion, or 64%, while profit attributable to owners of the parent company was ¥107.9 billion, surging ¥44.7 billion, or 70.6%, from the previous year, as higher selling prices exceeded the impact of higher raw material and fuel prices. Each profit indicator registered record highs for the year. The operating income ratio and ROE, two management indices that Tosoh gives weight to, were 15.7% and 16.3%, respectively, surpassing company targets.

Fiscal 2022 marked the final year of the three-year medium-term business plan launched in fiscal 2020. Under the plan, with the aim of creating a robust business portfolio, Tosoh worked to stabilize and expand earnings based on a well-balanced dual management strategy of strengthening Commodities (Petrochemical and Chlor-alkali products), for which demand is solid, and Specialties (specialty products), which feature high added value.

In the second half of fiscal 2020, the first year of the plan, the Tosoh Group’s business was impacted on various fronts due to the COVID-19 outbreak and subsequent global pandemic. Tough conditions persisted into the first quarter of fiscal 2021 when we recorded an operating loss. Despite this, we managed to achieve all our medium-term targets of ¥890.0 billion in net sales, ¥110.0 billion in operating income, an operating income ratio over 10% and ROE over 10%, following a change in the business environment from the second half of fiscal 2021, which saw a recovery in market conditions for the Chlor-alkali business and higher prices for PVC products and polyurethane raw materials.

Performance under medium-term business plan (FY2020-2022)

|

FY2022 |

|

Target |

Results |

Variance |

| Net sales (billions of yen) |

890 |

918.6 |

28.6 |

| Operating income |

110 |

144 |

34 |

| Operating income ratio (%) |

Above 10 |

15.7 |

Achieved |

| ROE (%) |

Above 10 |

16.3 |

Achieved |

Medium- to long-term growth strategy

Aim to create a profit base of over ¥100 billion in the specialty group

Continuing to strengthen the Company’s dual management strategy and steadily transitioning to a business structure that is less susceptible to changes in the external business environment form the basis of our growth plan from a medium- to long-term perspective. Our business model of generating new growth drivers through continuous investment in development in specialty fields while securing cash flow and profits, which is the foundation of our Commodity business, remains the cornerstone of this approach. Balancing business expansion in commodities with the need for decarbonization will, however, be the focus of the Tosoh Group’s growth strategy going forward.

Caustic soda, PVC resin, and other products provided by our commodity operations are vital for the sustainable development of society, and as such, demand for these items is expected to increase progressively alongside global economic growth. However, the production process for certain materials contained in commodity products requires a large amount of energy, and for that reason, it is essential that we determine the optimal direction of the Group’s production system, taking into consideration not only our ability to respond to rising demand but also how to minimize CO2 emissions in the production process.

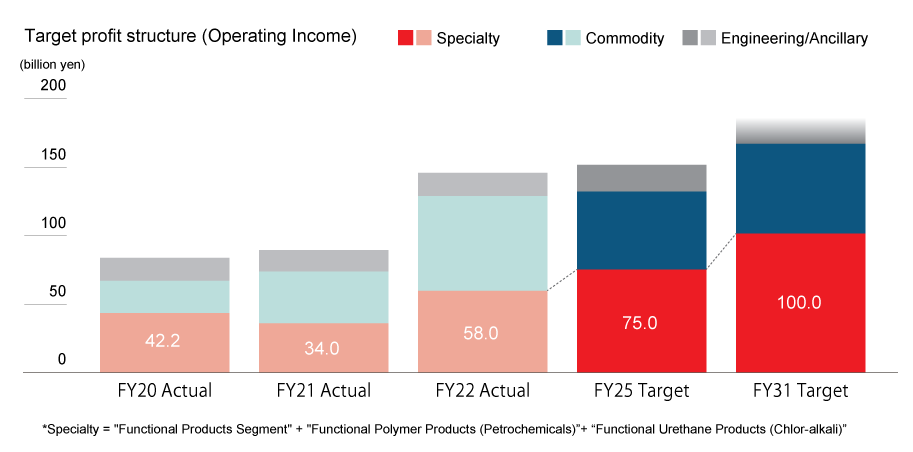

Although our Commodity businesses are an important source of earnings, we expect changes in the business environment amid the trend toward decarbonization due to the energy-intensive nature of this sector. As a result, the pressing challenges for management are to further reduce CO2 emissions in the product life cycle and further strengthen the high-value-added Specialty businesses as a solid pillar of earnings. We aim to create an earnings structure that can secure ¥100.0 billion in operating income annually in the Specialties over the medium to long term.

Desired profit structure (operating income)

New medium-term business plan and outlook for FY2023

Achieve both decarbonization and business growth

Tosoh announced a new three-year medium-term business plan in August 2022 in accordance with its medium- to long-term growth strategy. The new plan encompasses four basic management policies: Focus on expanding Specialty earnings while maintaining a dual management strategy based on the Commodity and Specialty businesses; make a concerted effort to reduce and effectively utilize CO2 emissions; invest aggressively based on a solid financial foundation; and strengthen safety infrastructure and establish and nurture a culture of safety. We will implement without delay measures to achieve decarbonization and further allocate management resources to growth areas and product domains with comparative advantages such as bioscience, advanced materials, bromine and chloroprene rubber. We also aim to utilize results from our R&D efforts in a strategic manner early on. Over the years, Tosoh has sown seeds in the R&D of next-generation products. As part of our medium-term business plan, we consistently conduct around 30 promising R&D projects with content modified depending on the progress of each research theme, in pursuit of the objective of developing several of these projects into foundations of growth for the next generation.

We are targeting net sales of ¥1,160.0 billion, operating income of ¥150.0 billion, an operating income ratio of over 10% and ROE of over 10% in fiscal 2025, the final year of the new plan.

In fiscal 2023, the first year of the plan, social and economic activities that were restricted globally due to COVID-19 are expected to gradually return to normal alongside progressive vaccine coverage. However, the global economic outlook remains uncertain due to the rising geopolitical risk triggered by Russia’s invasion of Ukraine, China’s prolonged zero-COVID policy, skyrocketing resource and raw material prices and supply chain disruptions. Accordingly, we need to pay close attention to the current business environment while focusing on a medium- to long-term approach to decarbonization and business growth. We will strive to secure earnings through such measures as responding quickly and flexibly to business risks posed by market uncertainties, reflecting cost increases in product prices, saving energy, reducing costs and promoting the use of alternative fuels.

Against this backdrop, on a consolidated basis for fiscal 2023, we are forecasting net sales of ¥1,130.0 billion, operating income of ¥101.0 billion, an operating income ratio of 8.9%, ordinary income of ¥111.0 billion and net profit attributable to owners of the parent company of ¥74.0 billion.

On CSR management

Focus on safe and stable operations as a chemical manufacturer

In April 2019, we became a signatory to the UN Global Compact and are presently promoting activities based on the Compact’s 10 principles in the four areas of human rights, labor, environment, and anti-corruption. As interest in social issues such as climate change and human rights grows worldwide, corporations are increasingly expected to play their part in solving these challenges. In 2018, in order to execute high-level CSR management, Tosoh identified material issues in CSR that the Tosoh Group needs to address, set key performance indicators (KPIs) and medium-term targets for these material issues and is promoting initiatives to achieve them.

In fiscal 2022, we reviewed these material issues since our activities have taken root in the Company and are based on changes in the social environment. We evaluated the degree of importance of each issue in terms of its impact on the sustainable development of society and the Tosoh Group and incorporated feedback from external stakeholders before establishing nine material issues. Although each issue has a high degree of importance, we are focusing in particular on ensuring “safe and stable operations” and “product safety and quality management.” We believe our basic mission as a manufacturing company is to handle hazardous chemical substances in a safe manner and provide a secure and stable supply of high-quality chemicals, thereby contributing to society. This will also serve as a lifeline for the manufacturing industry.

Based on the underlying premise that safety takes precedence over everything else, Tosoh has continuously invested in renovation and undertaken preventive maintenance over the years. These efforts have led to a steady decrease in the number of abnormalities caused by manufacturing processes. Our policy is to utilize digital technologies such as AI and Internet of Things (IoT)-based operator assistance systems to ensure safe operation and prevent problems before they occur.

Focus on R&D of new technologies and products that resolve social issues

Along with safety and quality, one other material issue Tosoh is focused on is the creation and provision of products and technologies that resolve social issues. As mentioned earlier, SDGs serve as an important management guideline for the Tosoh Group and are consistently taken into account in the selection of our R&D themes. The Tosoh Group has set life sciences, electronic materials, and environment and energy as three critical areas for R&D that can contribute to resolving current social issues, and is concentrating R&D resources into these areas with the aim of creating new, high-value-added products that will drive the next stage of growth. We are promoting initiatives for materials informatics (MI) to streamline our R&D processes and are actively engaged in joint industry-academia research with universities and in open innovation with external research institutions. As an example, in the life sciences field, early on we embarked on the development of reagents that can quickly and easily detect nucleic acids (RNA) in the new coronavirus as well as its antibodies by utilizing our TRCReady®-80 molecular analyzer. Sales of the reagents began in August 2020, serving to greatly reduce the workload of medical and testing personnel. In the environment and energy field, we developed technology related to the recycling of multilayer plastic films through industry-government-academia collaboration with the aim of resolving the growing global concern of plastic waste.

Going forward, the importance of decarbonization-related research is expected to increase, given the global trend toward decarbonizing society. Developed in collaboration with Kyushu University, Tosoh has already succeeded in introducing technology to recover CO2 emitted from fossil fuel boilers at high purity through the use of an innovative CO2 separation membrane. We intend to conduct further R&D aimed at converting recovered CO2 into raw material through open innovation.

ESG initiatives

Invest ¥120 billion to reduce GHG emissions

Tosoh is also focusing on nonfinancial initiatives such as environment, social and governance (ESG) issues to drive ongoing corporate growth. As a chemical manufacturer, over the past several decades we have made continuous efforts related to environmental conservation including pollution control, waste reduction and energy conservation. In recent years, the reduction of CO2, considered to be the major cause of climate change, has been designated as one of the most urgent environmental issues facing management and we are strengthening our efforts in this regard. In November 2019, we announced our endorsement of the recommendations of the Task Force on Climate-Related Financial Disclosure (TCFD) and are now analyzing scenarios related to the impact of climate change on business activities in line with the framework.

In January 2022, we announced a new greenhouse gas (GHG) reduction policy for the Tosoh Group to achieve carbon neutrality by 2050 through a 30% reduction of GHG emissions by fiscal 2031 relative to fiscal 2019 levels. In addition to standard capital investment, Tosoh will invest approximately ¥120 billion by fiscal 2031 on measures to reduce GHG emissions with a focus on more aggressively conserving energy, decarbonization, and promoting recovery and effective use of CO2. We will invest about ¥60 billion of that sum over the three years of the current medium-term business plan.

Although the thermal power generation facilities at Tosoh’s Nanyo and Yokkaichi Complexes are a source of competitive advantage, we are also faced with the urgent challenge of reducing CO2 emitted during operation. In June 2021, we established the CO2 Reduction and Effective Use Strategy Team with task forces at the Nanyo and Yokkaichi Complexes, in a step to look further into ways to separate, recover and effectively utilize the CO2 emitted by applying technology developed in-house alongside energy-saving production processes and the use of alternative fuels.

Focus on developing self-reliant human resources that can respond flexibly to changes in the environment

From a social perspective, we place particular emphasis on human resources, said to be the greatest asset of a company. The Tosoh Group supports the aims of the United Nations (UN) Universal Declaration of Human Rights, the International Labour Organization (ILO) Declaration on Fundamental Principles and Rights at Work, and the UN Guiding Principles on Business and Human Rights. In addition to promoting initiatives associated with respect for human rights, we are working to foster a work environment where all employees can fully develop their abilities and attain growth while maintaining high levels of motivation.

In fiscal 2022, we revised our basic policy for human resource development. The new policy aims to develop self-reliant personnel who can create their own tasks and roles and involve others toward the attainment of their goals, whether inside or outside the organization. They must have their own vision of how they would respond to changes in the business environment and be motivated to learn and persevere in fufilling that vision. In my view, this does not mean that we have introduced an entirely new way of thinking; rather, we have characterized the quality of our carefully cultivated corporate culture and crystallized it as a basic policy for human resource development. I believe that this way of thinking, which values self-reliance and independence, is especially important in today's diverse, complex and ever-changing world. As head of the management team, I believe that an important mission is to develop human resources that can respond to changes and challenges in the business environment with confidence and self-reliance.

Aim to raise corporate value through sound, highly transparent management

Tosoh recognizes that corporate governance is also an important foundation for driving sustainable growth and is working to create an efficient organizational structure that can respond quickly and efficiently to changes in the environment and implement highly transparent corporate management. In 2020, we increased the number of external directors on the Board of Directors from two to four, including one female director, raising the proportion of external directors on the Board to 44%. The Nomination and Compensation Advisory Committee to the Board consists of six members, including two internal and four external directors, with the head of the committee selected from one of the external directors. In addition, in 2021 the Board of Auditors increased the number of external auditors from two to three, one of whom is a full-time auditor, to further strengthen the supervisory function over the directors in the execution of their duties.

With regard to compliance, we aim to be a sound corporate group that earns the trust of society by not only complying with laws and regulations in all countries where we conduct business, but also by operating thorough internal control systems, establishing a compliance consultation service and strengthening and expanding compliance education.

To our stakeholders: Ensure ongoing growth and become an even more highly trusted corporate group

When I assumed the position of president, I viewed the business environment as satisfactory yet challenging. While fiscal 2022 saw record high sales and profit for the Tosoh Group, we recognize that major challenges lie ahead, including in the area of decarbonization. Moreover, changes in the external environment and social instability have put significant pressure on both the world economy and our own business environment.

I anticipate that the Tosoh Group will have to overcome numerous difficult hurdles in order to achieve further growth. Since our founding in 1935, we have managed to emerge from several very trying circumstances and keep growing. This has only been possible with the support of all our stakeholders.

Tosoh will continue striving to “Contribute to society through the chemistry of innovation” with the aim of remaining a company that is trusted by customers, shareholders, investors and all stakeholders. I would like to ask for your continued support and cooperation as we forge ahead toward the future.

Mamoru Kuwada

Representative Director, President